Navigating the complex world of mutual funds can feel overwhelming, especially when faced with a plethora of financial jargon and metrics. However, amidst this complexity, one indicator stands out as particularly crucial for investors: the Net Asset Value, or NAV. Understanding why NAV is the most important thing in a mutual fund is essential for making informed investment decisions and accurately assessing the fund’s performance. This single number encapsulates the fund’s overall value, providing a snapshot of its worth at a specific point in time, and it’s more than just a price tag; it’s a window into the fund’s underlying assets and its potential for future growth.

Understanding Net Asset Value (NAV)

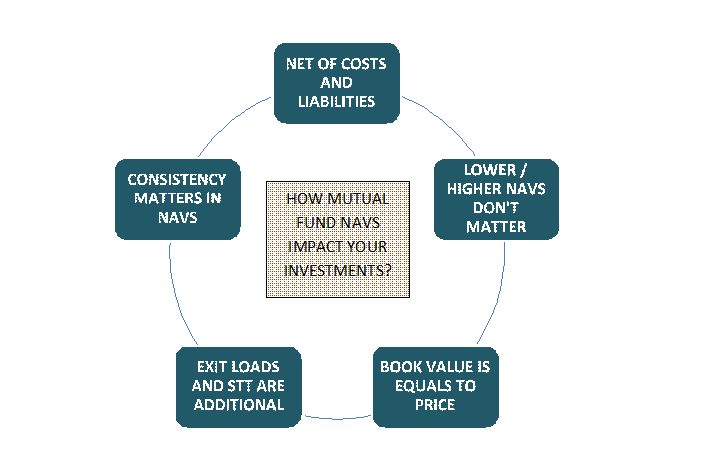

The Net Asset Value (NAV) of a mutual fund represents the per-share value of the fund’s assets after deducting liabilities. It’s essentially the price at which you can buy or sell a share of the fund on any given day. The NAV is calculated at the end of each trading day by subtracting the fund’s total liabilities from its total assets, and then dividing the result by the number of outstanding shares.

- Assets: Include all the fund’s holdings, such as stocks, bonds, and cash.

- Liabilities: Include expenses such as management fees, operating costs, and any debts the fund may have.

- Outstanding Shares: The total number of shares held by investors.

Why NAV Matters to Investors

The NAV serves as the primary benchmark for assessing a mutual fund’s performance and making informed investment decisions. Here are several key reasons why NAV is so important:

Accurate Valuation

The NAV provides a daily snapshot of the fund’s market value, reflecting the current worth of its underlying assets. This allows investors to track the fund’s performance over time and see how their investment is growing (or shrinking).

Fair Pricing

When you buy or sell shares of a mutual fund, you do so at the NAV. This ensures that you are getting a fair price for your investment, based on the fund’s actual worth. This transparency is crucial for maintaining investor confidence.

Performance Comparison

By comparing the NAVs of different mutual funds, investors can assess which funds have performed better over a given period; This allows for a more objective evaluation than simply looking at the fund’s name or marketing materials.

Tracking Investment Growth

Monitoring the NAV over time is crucial for tracking the growth of your investment. It allows you to see how the fund is performing relative to its benchmark and your own investment goals.

Understanding the factors that influence NAV is crucial. Market fluctuations directly impact the value of the fund’s holdings. A rising stock market will generally lead to an increase in the NAV of a stock fund, while a falling market will likely cause it to decrease. Similarly, changes in interest rates can affect the NAV of bond funds.

Beyond the Number: Considerations Beyond NAV

While NAV is a critical metric, it’s essential to consider it in conjunction with other factors when evaluating a mutual fund. These include the fund’s investment objective, expense ratio, risk profile, and the experience and track record of the fund manager.