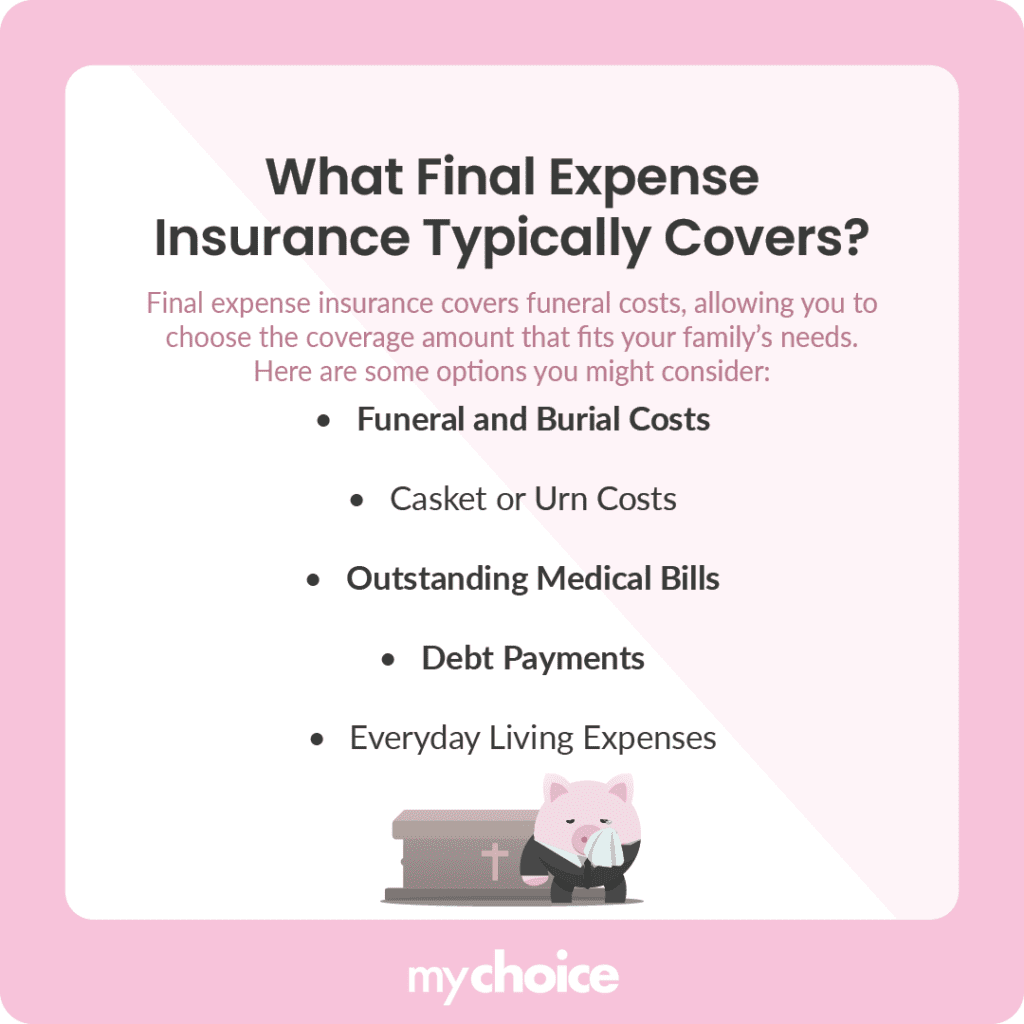

Final expense insurance, also known as burial insurance or funeral insurance, is a type of whole life insurance policy designed to cover end-of-life expenses. These expenses can include funeral costs, burial expenses, cremation fees, medical bills, and other related debts. Understanding the nuances of final expense insurance is crucial for individuals seeking to ease the financial burden on their loved ones during a difficult time. This type of insurance is often considered a smaller, more manageable policy compared to traditional life insurance.

Final expense insurance differs from traditional life insurance in several key aspects. While traditional life insurance aims to provide a larger death benefit to cover a wide range of financial needs, final expense insurance focuses specifically on covering the costs associated with a person’s passing. The application process is often simpler, with fewer medical questions or even no medical exam required. This makes it a more accessible option for seniors or individuals with pre-existing health conditions who may find it difficult to qualify for traditional life insurance.

Key Features of Final Expense Insurance:

- Smaller Death Benefit: Typically ranges from $5,000 to $25,000.

- Simplified Application: Fewer medical questions or no medical exam.

- Guaranteed Acceptance: Some policies offer guaranteed acceptance, regardless of health.

- Whole Life Policy: Provides lifelong coverage as long as premiums are paid.

- Level Premiums: Premiums remain constant throughout the policy’s duration.

Is Final Expense Insurance Right for You?

Determining whether final expense insurance is the right choice depends on your individual circumstances and financial needs. Consider the following factors:

- Funeral Costs: Have you considered the average cost of a funeral in your area? These costs can range from several thousand to tens of thousands of dollars.

- Existing Life Insurance: Do you already have sufficient life insurance coverage to cover end-of-life expenses?

- Financial Situation: Can your loved ones afford to cover these expenses out of pocket?

- Age and Health: Are you a senior or do you have pre-existing health conditions that make it difficult to qualify for traditional life insurance?

Pros and Cons of Final Expense Insurance

Like any financial product, final expense insurance has its advantages and disadvantages.

Pros:

- Ease of Access: Simplified application process and guaranteed acceptance options make it accessible to a wider range of individuals.

- Peace of Mind: Provides peace of mind knowing that your loved ones will not be burdened with the financial costs of your passing.

- Fixed Premiums: Premiums remain level throughout the policy’s duration, providing budget stability.

- Cash Value Accumulation: As a whole life policy, it accumulates cash value over time.

Cons:

- Higher Cost per Coverage: The cost per dollar of coverage is generally higher compared to traditional life insurance.

- Smaller Death Benefit: The death benefit may not be sufficient to cover all expenses beyond funeral costs.

- Limited Investment Potential: The cash value growth is typically conservative compared to other investment options.

Final Thoughts

Final expense insurance can be a valuable tool for individuals seeking to protect their loved ones from the financial burden of end-of-life expenses. Carefully consider your individual needs and circumstances before making a decision.

Remember to compare quotes from multiple insurance providers to ensure you are getting the best possible rate and coverage. It’s important to weigh the pros and cons and determine if it aligns with your overall financial planning goals.