Running a business often feels like juggling a million different tasks simultaneously, and managing finances can quickly become one of the most overwhelming. Streamlining your payment processes is crucial for efficiency, improved cash flow, and ultimately, business growth. Fortunately, innovative solutions like Pinch Payments are emerging to address these challenges. Pinch Payments offer a simplified and streamlined approach to handling business transactions, allowing you to focus on what truly matters: growing your company and serving your customers.

Understanding the Complexities of Traditional Payment Systems

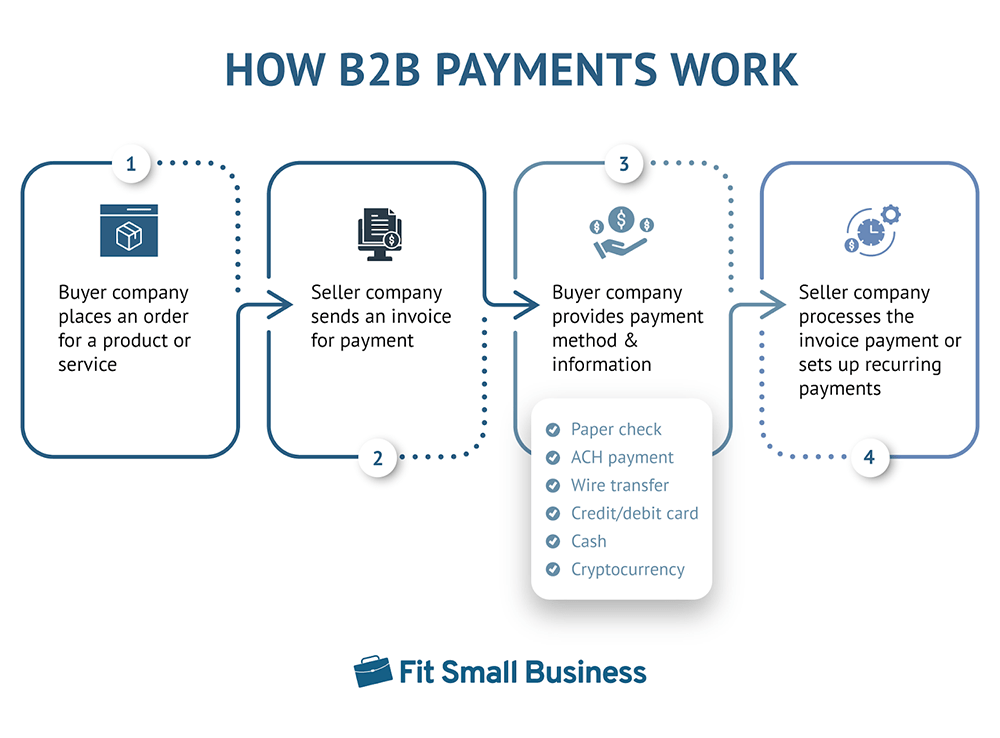

Traditional payment systems can be a labyrinth of complexity. From navigating various merchant fees to reconciling bank statements, the process can be time-consuming and prone to errors. Consider the challenges businesses face:

- High Transaction Fees: Traditional payment processors often charge hefty fees, eating into your profit margins.

- Slow Processing Times: Waiting days for payments to clear can disrupt cash flow and hinder your ability to invest in your business.

- Complex Reconciliation: Manually matching payments with invoices is a tedious and error-prone task.

- Limited Payment Options: Offering only a few payment methods can alienate potential customers.

How Pinch Payments Offer a Solution

Pinch Payments offer a refreshing alternative, designed to simplify and streamline the payment process. They provide a user-friendly platform that integrates seamlessly with your existing systems, offering a range of benefits that can significantly impact your business.

Key Benefits of Using Pinch Payments

- Reduced Transaction Fees: Pinch Payments often offer more competitive transaction fees compared to traditional processors, saving you money on every transaction.

- Faster Processing Times: Experience quicker payment processing, improving your cash flow and allowing you to reinvest in your business sooner.

- Automated Reconciliation: The platform automates the reconciliation process, eliminating manual data entry and reducing the risk of errors.

- Expanded Payment Options: Offer your customers a wider range of payment options, including credit cards, debit cards, and direct bank transfers, improving customer satisfaction and increasing sales.

Pinch Payments vs. Traditional Payment Systems: A Comparison

| Feature | Pinch Payments | Traditional Payment Systems |

|---|---|---|

| Transaction Fees | Competitive, often lower | Can be high and unpredictable |

| Processing Time | Faster | Slower |

| Reconciliation | Automated | Manual |

| Payment Options | Wider range | Limited |

| Integration | Seamless | Can be complex |

Ultimately, the decision to switch to a new payment system depends on your specific business needs and priorities. However, the potential benefits of increased efficiency, reduced costs, and improved customer satisfaction make Pinch Payments a compelling option for businesses of all sizes.

Beyond the Basics: Unlocking Hidden Potential with Pinch Payments

But the story doesn’t end with just streamlined transactions and happy accountants. Pinch Payments are more than just a digital hand taking money; they’re a key to unlocking hidden potential within your business. Imagine a world where payment data becomes a treasure trove of insights, revealing customer behavior patterns you never knew existed. This is the power that lies dormant within the digital arteries of your payment system.

Turning Data into Dollars: Actionable Insights from Your Transactions

Forget dusty reports and confusing spreadsheets. Pinch Payments can provide you with a clear, concise dashboard that visualizes your transaction data in real-time. Think of it as your business’s financial heartbeat, pulsing with valuable information. You can:

- Identify Peak Sales Periods: Pinpoint the exact times of day or days of the week when your sales surge, allowing you to optimize staffing and marketing efforts.

- Understand Customer Preferences: Analyze purchase patterns to identify your most popular products or services, and tailor your offerings accordingly.

- Predict Future Trends: Use historical data to forecast future sales, allowing you to proactively manage inventory and plan for growth.

- Personalize Customer Experiences: Offer targeted promotions and discounts based on individual customer purchase history, fostering loyalty and increasing repeat business.

The Rise of the ‘Subscription Economy’ and Pinch Payments

In today’s world, the subscription model reigns supreme. From streaming services to meal kits, consumers are increasingly opting for recurring payment plans. Pinch Payments are perfectly suited to manage these complex subscription arrangements, offering features like automated billing, failed payment retries, and customizable subscription options. This allows you to focus on delivering value to your subscribers, rather than wrestling with the intricacies of recurring payments.

Imagine This: A Future Powered by Seamless Transactions

Close your eyes for a moment and envision a future where payments are invisible, frictionless, and seamlessly integrated into every aspect of your business. Customers breeze through checkout, payments are automatically reconciled, and your financial data provides you with the insights you need to make informed decisions. This isn’t a futuristic fantasy; it’s the reality that Pinch Payments can help you create today. The power to transform your business, one transaction at a time, is now within your grasp.