Navigating the financial landscape can often feel like traversing a complex maze‚ especially when unexpected expenses arise or opportunities demand immediate capital. The need for accessible and adaptable financial solutions is paramount in today’s fast-paced world. Quick & Easy Loans with Flexible Terms are designed to address this very need‚ providing individuals and businesses with a streamlined path to acquiring necessary funds. These loans offer a simplified application process‚ faster approval times‚ and‚ most importantly‚ customized repayment plans that align with individual financial circumstances. This ensures that borrowing becomes a manageable and empowering experience‚ rather than a source of stress.

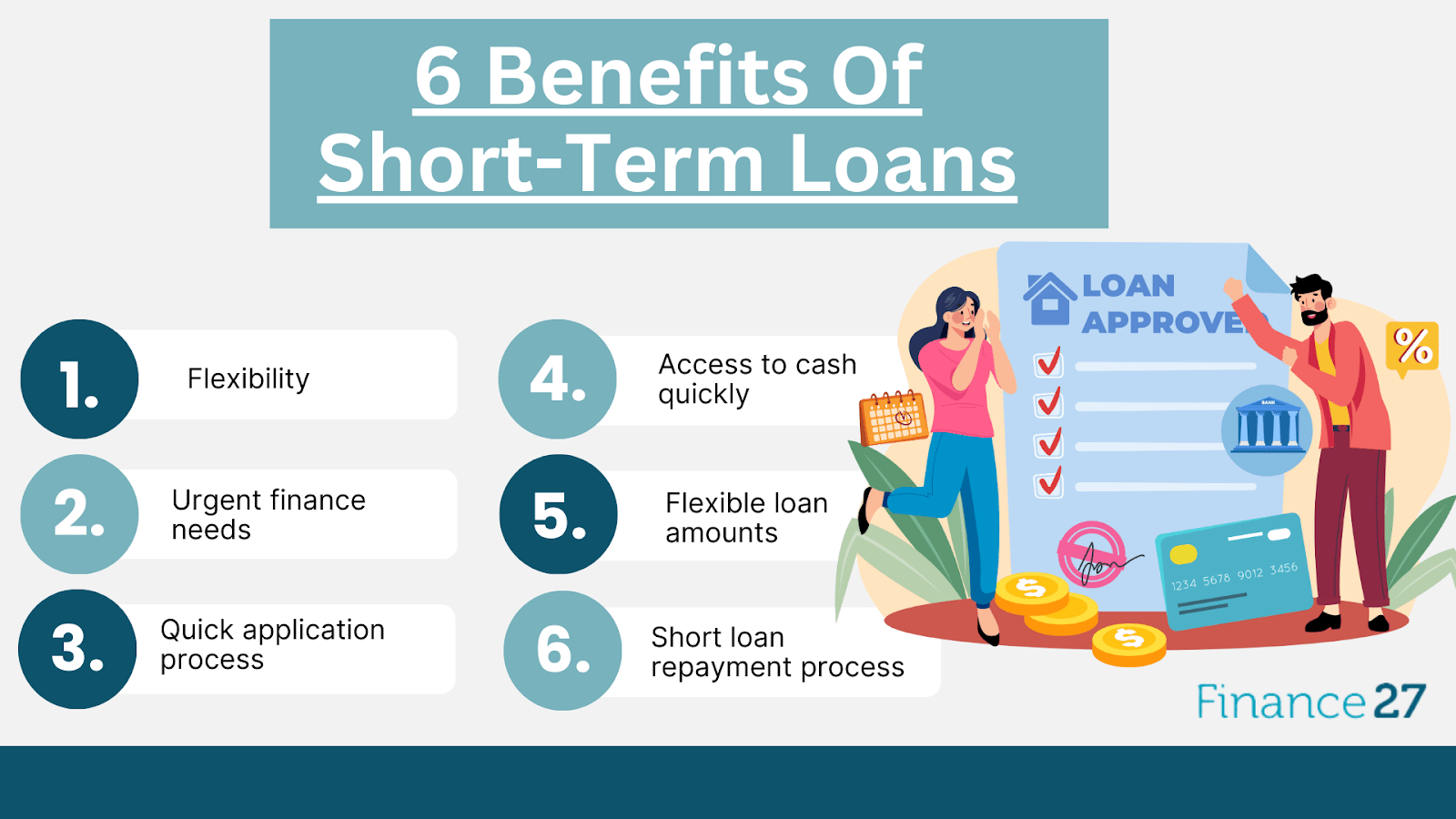

The allure of Quick & Easy Loans with Flexible Terms lies in their adaptability. Unlike traditional loan products with rigid structures‚ these loans prioritize the borrower’s unique situation. Here’s a glimpse into the key advantages:

- Customized Repayment Schedules: Tailored to your income cycle‚ ensuring affordability.

- Adjustable Loan Amounts: Borrow only what you need‚ avoiding unnecessary debt.

- Potential for Loan Modifications: Adaptations can be made if your financial situation changes.

Who Benefits from Quick & Easy Loans?

A wide range of individuals and businesses can find value in these flexible loan options. Consider these scenarios:

- Small Business Owners: Securing working capital for inventory or marketing campaigns.

- Freelancers and Gig Workers: Bridging income gaps between projects.

- Individuals Facing Unexpected Expenses: Covering medical bills‚ car repairs‚ or home improvements.

One of the defining characteristics of these loans is the streamlined application process. Traditional loan applications can be lengthy and demanding‚ requiring extensive documentation and lengthy approval times. Quick & Easy Loans with Flexible Terms typically involve:

- Online Application: A user-friendly online form that can be completed in minutes.

- Minimal Documentation: Reduced paperwork requirements compared to traditional loans.

- Rapid Approval: Faster processing times‚ often with decisions made within hours or days.

While the flexibility of these loans is a significant advantage‚ it’s crucial to approach borrowing responsibly. Consider these tips:

- Assess Your Needs: Borrow only what you truly need and can comfortably repay.

- Compare Offers: Shop around to find the most favorable interest rates and terms.

- Understand the Fine Print: Carefully review all loan documentation before signing.

Navigating the financial landscape can often feel like traversing a complex maze‚ especially when unexpected expenses arise or opportunities demand immediate capital. The need for accessible and adaptable financial solutions is paramount in today’s fast-paced world. Quick & Easy Loans with Flexible Terms are designed to address this very need‚ providing individuals and businesses with a streamlined path to acquiring necessary funds. These loans offer a simplified application process‚ faster approval times‚ and‚ most importantly‚ customized repayment plans that align with individual financial circumstances. This ensures that borrowing becomes a manageable and empowering experience‚ rather than a source of stress.

Understanding the Appeal of Flexible Loan Terms

The allure of Quick & Easy Loans with Flexible Terms lies in their adaptability. Unlike traditional loan products with rigid structures‚ these loans prioritize the borrower’s unique situation. Here’s a glimpse into the key advantages:

- Customized Repayment Schedules: Tailored to your income cycle‚ ensuring affordability.

- Adjustable Loan Amounts: Borrow only what you need‚ avoiding unnecessary debt.

- Potential for Loan Modifications: Adaptations can be made if your financial situation changes.

Who Benefits from Quick & Easy Loans?

A wide range of individuals and businesses can find value in these flexible loan options. Consider these scenarios:

- Small Business Owners: Securing working capital for inventory or marketing campaigns.

- Freelancers and Gig Workers: Bridging income gaps between projects.

- Individuals Facing Unexpected Expenses: Covering medical bills‚ car repairs‚ or home improvements.

The Application Process Simplified

One of the defining characteristics of these loans is the streamlined application process. Traditional loan applications can be lengthy and demanding‚ requiring extensive documentation and lengthy approval times. Quick & Easy Loans with Flexible Terms typically involve:

- Online Application: A user-friendly online form that can be completed in minutes.

- Minimal Documentation: Reduced paperwork requirements compared to traditional loans.

- Rapid Approval: Faster processing times‚ often with decisions made within hours or days.

Maximizing the Benefits of Flexible Loan Options

While the flexibility of these loans is a significant advantage‚ it’s crucial to approach borrowing responsibly. Consider these tips:

- Assess Your Needs: Borrow only what you truly need and can comfortably repay.

- Compare Offers: Shop around to find the most favorable interest rates and terms.

- Understand the Fine Print: Carefully review all loan documentation before signing.

Exploring the Nuances: Is This Right for You?

But are you still unsure if a flexible loan is the right path? Have you considered all the angles? Let’s delve deeper with some crucial questions.

Interest Rates and Fees: Are You Truly Saving?

While the term “quick & easy” is appealing‚ shouldn’t you always scrutinize the fine print? Are the interest rates competitive compared to traditional loan options? What about origination fees‚ prepayment penalties‚ or late payment charges? Could these hidden costs negate the benefits of flexible repayment? Shouldn’t you compare the total cost of borrowing‚ including all fees and interest‚ across different lenders before making a decision? Are you truly understanding the APR (Annual Percentage Rate) and how it impacts your overall repayment? Shouldn’t you also inquire about potential discounts for good credit scores or automatic payments?

Financial Stability: Are You Prepared for the Unexpected?

Even with flexible terms‚ what happens if your income suddenly decreases? Have you created a contingency plan to cover loan payments during periods of financial hardship? Should you assess your budget and identify areas where you can cut expenses to ensure loan repayment even in challenging times? Could a job loss‚ unexpected medical bill‚ or other unforeseen circumstance derail your ability to meet your obligations? Shouldn’t you consider purchasing loan insurance or exploring alternative options like debt consolidation if you’re already struggling with debt? Are you confident that your current financial situation is stable enough to handle the responsibility of a loan‚ even with flexible terms? Should you consult with a financial advisor to assess your situation and determine if a loan is truly the best option?

Long-Term Goals: Does This Align with Your Future?

How will taking out a Quick & Easy Loan with Flexible Terms impact your long-term financial goals? Will it hinder your ability to save for retirement‚ purchase a home‚ or invest in other opportunities? Should you consider the opportunity cost of borrowing money and weigh it against the potential benefits? Are you using the loan for a productive purpose that will generate a return on investment‚ or are you simply using it to cover discretionary expenses? Could delaying the purchase or finding alternative funding sources be a more prudent approach in the long run? Shouldn’t you evaluate whether the loan aligns with your overall financial plan and helps you achieve your long-term aspirations?